Seeking support through federal assistance programs? Find out how SNAP, TANF, and housing assistance could offer the financial relief you need. This article details key information to understand and apply for the benefits designed to support individuals and families experiencing hardship.

Key Takeaways

- Federal assistance programs provide support for basic needs, housing, healthcare, and more for individuals facing economic hardship through benefits like SNAP, TANF, and the Housing Choice Voucher Program.

- Specialized assistance programs target specific demographics such as veterans, seniors, and students, with services ranging from financial aid for living expenses to educational grants and loan repayment assistance.

- The government also supports economic and financial empowerment through various means, including the provision of tax credits like the EITC and CTC, support for small businesses through loans and grants, and measures to protect against scams.

Understanding Federal Assistance Programs

Government assistance programs, also known as government benefits, are a safety net designed to support low-income individuals and families. Whether you’re facing unemployment, disability, or simply struggling to make ends meet, these programs can help cover your basic needs. A range of resources, such as the Supplemental Nutrition Assistance Program (SNAP), Temporary Assistance for Needy Families (TANF), Supplemental Security Income, and Veterans Administration Healthcare, as well as other government benefits, are available to those in need. These programs can provide crucial support and assistance to individuals and families facing economic hardship.

We will now examine these programs and their potential to offer support in challenging circumstances.

Exploring the Supplemental Nutrition Assistance Program (SNAP)

SNAP provides vital support for eligible low-income households grappling with food insecurity. It offers nutrition benefits that help families afford a healthy diet. The eligibility criteria is based on state-imposed income limits and an assessment of resources, such as bank account balances.

A range of application channels from online to in-person submissions ensure accessibility for unemployment benefits. Once approved, beneficiaries receive monthly benefits on an Electronic Benefits Transfer (EBT) card, which can be conveniently managed through a state-provided mobile app.

Insights into Temporary Assistance for Needy Families (TANF)

TANF serves as a crucial support for families dealing with temporary hardships. This federally funded, state-run program provides temporary financial assistance for:

- food

- housing

- home energy

- childcare

- job training

It also offers supportive services like arranging childcare and transportation. Emphasizing attendance and punctuality, TANF also offers resources such as workshops and job fairs to aid recipients on their journey towards self-sufficiency.

Applications can be submitted at a local county social services agency, and recipients are encouraged to work with their case manager to develop a plan that meets their needs.

Unpacking the Affordable Connectivity Program (ACP)

In our increasingly digital world, internet connectivity has become a necessity. The Affordable Connectivity Program (ACP) ensures that eligible households maintain this essential link by offering monthly discounts on broadband services and electronic devices. To qualify, household income must be at or below 200% of the Federal Poverty Level, or a member of the household must meet certain criteria such as participating in government assistance programs.

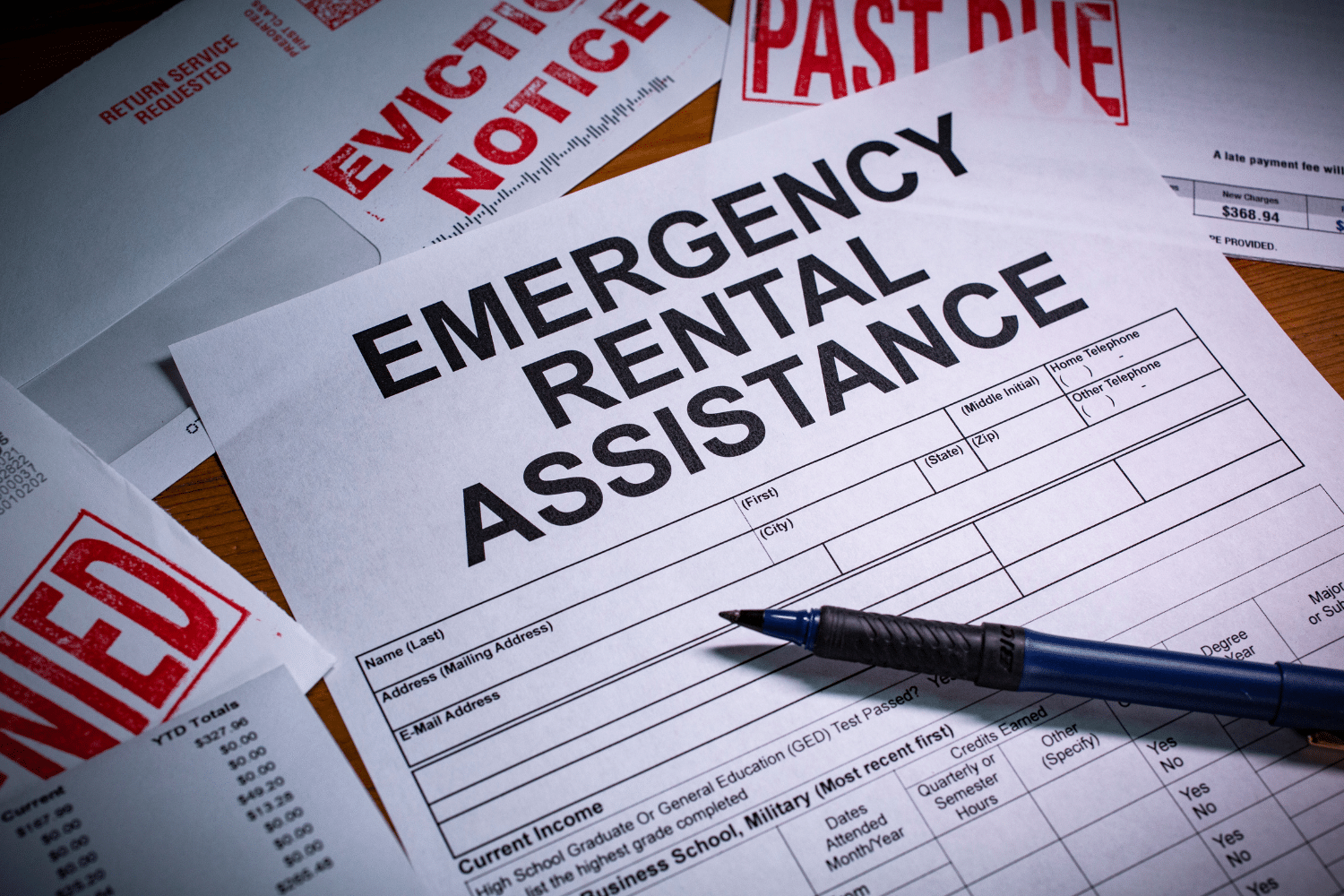

Housing Aid: Federal Public Housing Assistance and Beyond

Housing is a basic human need, and federal assistance programs play a critical role in ensuring that everyone has a roof over their heads. Programs like the Housing Choice Voucher Program and Federal Housing Administration (FHA) loans provide options for renters and homebuyers alike.

We will now further investigate these opportunities and their potential to facilitate affordable and safe housing.

Navigating the Housing Choice Voucher Program

The Housing Choice Voucher Program offers critical support to low-income families burdened by housing costs. This program provides eligible families with vouchers that cover a portion of their rent, ensuring that safe and decent housing is within reach.

With factors such as income, family status, and citizenship determining eligibility, the program is designed to reach those who need it the most.

Unlocking Access with Federal Housing Administration (FHA) Loans

Homeownership is a dream for many, and FHA loans bring that dream within reach for eligible borrowers. By insuring loans, the FHA allows lenders to offer better deals, such as low down payments and easier qualification standards regarding credit. These loans are available for a variety of properties, accommodating diverse housing needs.

With a minimum down payment of 3.5% and a credit score of 580, the dream of owning a home can become a reality.

The Role of Public Housing Programs

Public housing programs play a crucial role in providing safe and affordable rental housing for eligible low-income families, the elderly, and persons with disabilities. Depending on income, family size, and other factors, residents can stay in public housing for as long as they comply with their lease and their income does not exceed certain limits.

These programs are an essential part of the government’s efforts to ensure that everyone has access to safe and affordable housing.

Medical Coverage for Those in Need

Healthcare is a fundamental necessity, and the government has stepped up to ensure that low-income families and specific demographics have access to essential medical services. Through programs like Medicaid, Medicare, and the ACA Health Insurance Marketplace, millions of Americans are able to receive the healthcare they need.

Health Insurance Marketplace Options

The Health Insurance Marketplace is a treasure trove of affordable health insurance options for individuals, families, and small businesses. Offering a variety of plans categorized into metal tiers, the Marketplace ensures that everyone can find a plan that suits their needs and budget.

All Marketplace plans cover a set of essential health benefits, guaranteeing coverage for pre-existing conditions, and providing financial assistance in the form of subsidies to eligible individuals and families.

Medicaid and Children’s Health Insurance Program (CHIP) Coverage

Medicaid and CHIP provide essential support to low-income individuals and families, offering free or low-cost health coverage. Eligibility is often based on income, and the application process is open year-round, ensuring that help is always available for those who need it.

These programs have been linked to a reduction in racial disparities in health insurance coverage and improved health outcomes for children, demonstrating their profound impact on society.

Support for Specific Demographics

While everyone faces unique challenges, certain demographics such as veterans and seniors often require tailored support. That’s where specialized assistance programs come into play, offering housing, healthcare, and education assistance tailored to their specific needs.

We will now explore these programs and their potential to provide specialized assistance.

Veterans Pension and Assistance Programs

Veterans have made immense sacrifices for our country, and it’s only right that we support them in return. From VA loans to financial support for living expenses and medical treatments, a host of programs are available to assist veterans and active-duty service members. These programs offer a lifeline for many veterans, providing financial stability and access to essential services.

Senior Assistance: Social Security and Other Benefits

Seniors often face unique challenges, including fixed incomes and increased healthcare needs. Thankfully, programs like Social Security, Medicare, and other assistance programs are available to help. From retirement benefits to health insurance, these programs provide crucial support to older Americans, ensuring that they can enjoy their golden years without financial stress.

Educational Grants and Loan Repayment Assistance

Education is a powerful tool for economic mobility, and various grants and loan repayment assistance programs are available to support students attending college or pursuing higher education. From the Federal Pell Grant to the Teacher Education Assistance for College and Higher Education (TEACH) Grant, these programs provide financial support to help students reach their academic goals.

Energy and Utility Bill Relief

Keeping the lights on and maintaining essential services can be a burden when you’re struggling financially. Assistance is readily accessible through programs such as the Lifeline Program and the Low Income Home Energy Assistance Program (LIHEAP), providing support to those in need. These programs offer financial assistance to manage energy costs and keep essential services running, creating a safety net for those in need.

Lifeline Program: Keeping Communication Affordable

In today’s connected world, phone and internet services are more than a convenience – they’re necessary for daily life. The Lifeline Program offers discounts on these services for qualifying low-income consumers, ensuring that everyone has access to essential communication services.

Whether it’s looking for a job, staying in touch with family, or accessing emergency services, the Lifeline Program helps keep the lines of communication open.

Low Income Home Energy Assistance Program (LIHEAP)

LIHEAP provides critical assistance to low-income households struggling to manage their energy costs. Whether it’s heating in the winter or cooling in the summer, LIHEAP ensures that everyone can maintain a comfortable and safe home. The program also provides emergency services for energy crises and offers weatherization and other energy-related minor home repairs.

Financial Empowerment Through Tax Credits

Tax credits are a powerful tool for financial empowerment, reducing the amount of income tax that you have to pay. By maximizing your Earned Income Tax Credit (EITC) and understanding the essentials of the Child Tax Credit, you can ensure that you’re getting the most out of your tax return.

These credits can make a significant difference in your financial situation, providing extra funds that can be used to cover basic living expenses and other essential expenses.

Maximizing the Earned Income Tax Credit (EITC)

The EITC offers significant benefits to low to moderate-income workers and families by reducing the amount of tax owed and potentially increasing their tax refund. The amount of EITC benefit varies based on the taxpayer’s family situation, including the presence of children or dependents.

The Internal Revenue Service (IRS) provides resources to help taxpayers determine their eligibility and understand the qualifications for the EITC.

Child Tax Credit Essentials

The Child Tax Credit (CTC) is designed to assist families with children, especially those with little or no income. The credit calculation is being revamped to provide a higher benefit for poor families.

Some key points about the Child Tax Credit:

- It is designed to assist families with children

- It provides a higher benefit for poor families

- The maximum refundable amount of the CTC is expected to rise incrementally over the next few years.

These changes are projected to benefit approximately 16 million children from low-income families.

Small Business Support via Government Programs

Starting and growing a small business can be a daunting task, but governmental support is available to lighten the load. From loans to grants, programs like the Small Business Lending Fund (SBLF) and USDA Business Programs provide the capital and technical help needed to stimulate rural business creation and growth.

We will now investigate these resources and their potential to support the growth of small businesses.

Small Business Administration (SBA) Loan Programs

Small businesses are the backbone of our economy, and the Small Business Administration (SBA) provides vital support to help them succeed. The SBA offers guaranteed loans designed to help businesses start, expand, or recover after disasters.

In addition to loans, SBA funding programs include debt and equity investments for businesses.

USDA Assistance for Rural Entrepreneurs

Rural entrepreneurs face unique challenges, but USDA Business Programs are here to help. These programs provide:

- Financial assistance

- Technical help

- Capital or equipment

- Space

- Job training

These programs offer the resources needed to start and grow rural businesses.

Identifying and Avoiding Scams

While federal assistance programs offer a lifeline to those in need, it’s vital to be vigilant and avoid scams that prey on individuals seeking help. Scammers often pose as government officials offering financial assistance, requesting personal and financial information under the guise of awarding grant money. Remember, official government grants require an application and are never associated with fees charged to the potential recipient.

Stay safe by reporting any potential scams to the Federal Trade Commission.

Summary

Federal assistance programs are a lifeline for many Americans, offering vital support for food, housing, healthcare, and more. Whether you’re a low-income individual, a veteran, a senior, or a small business owner, there’s a program designed to help you. Don’t let the process overwhelm you – with the right knowledge, you can navigate these programs and access the help you need. Remember, it’s not just about surviving, but about thriving. So take that first step today, and unlock the benefits that can help you navigate through challenging times.

Frequently Asked Questions

Federal assistance programs encompass a variety of forms such as grants, cooperative agreements, donations of property, food commodities, loans, interest subsidies, and insurance, aiming to directly assist governments, organizations, or individuals in areas like education and health.

Some examples of federal assistance include grants, cooperative agreements, donations of property, direct appropriations, food commodities, loans, and subsidies. Another example is the National School Lunch Program, which is a type of federal financial assistance.

You can seek community organizations and religious groups for small loans or short-term assistance to help with rent, utilities, or other emergency needs. Additionally, nonprofit associations in your area may offer small loans.

You can apply for these programs online, in person, or by mail. For specific instructions, it’s best to visit the official government website or contact the relevant government agency.

The eligibility criteria for these programs vary widely and may include income limits, family size, veteran or senior status, employment status, and disability among other factors. These criteria are important to consider before applying.