What is a Pell Grant, and how can you qualify for this college funding? With a focus on undergraduate students facing financial challenges, Pell Grants provide critical aid that does not require repayment. This article will detail eligibility, application steps, and points to consider, helping streamline your journey to securing educational funding through a Pell Grant.

Key Takeaways

- The Federal Pell Grant is a need-based form of educational financial aid for eligible undergraduate and certain post-baccalaureate students that does not have to be repaid, with the maximum award for the 2023-2024 school year set at $7,395.

- Eligibility for the Pell Grant is based on financial need assessed by the Student Aid Index, academic criteria that prioritize undergraduates without a bachelor’s or professional degree, and additional factors such as enrollment status and lifetime eligibility limits.

- Applying for a Pell Grant requires an annual submission of the FAFSA and eligibility is maintained through continued enrollment. The grant is disbursed directly to the student’s account, paid out to the student, or a combination of both, with proper allocation and management of funds being necessary.

Demystifying the Federal Pell Grant

The Federal Pell Grant, a program backed by the federal government, is a beacon of hope for students in need of financial support. As a form of federal student aid, it provides financial assistance to eligible undergraduate students and certain post-baccalaureate students who demonstrate financial need. What makes it even more appealing is that it doesn’t require repayment, unlike loans.

The Pell Grant program, one of the many grant programs available, is named in honor of U.S. Senator Claiborne de Borda Pell and has been assisting students since the 1973-1974 school year. It is specifically designed to support students who have not yet earned their first bachelor’s degree or who are enrolled in certain post-baccalaureate programs that lead to teaching certification or licensure.

Eligibility Criteria for Receiving Federal Pell Grants

Eligibility for Pell Grants is not merely a matter of academic achievement. It also takes into consideration factors like financial need, enrollment status, and lifetime eligibility limits.

We’ll now explore these criteria to better grasp how a student qualifies for a Pell Grant.

Financial Need Assessment

One of the main pillars of eligibility is the demonstration of financial need. This need is assessed through the Student Aid Index (SAI), formerly known as the Expected Family Contribution (EFC). The SAI is determined by the family’s financial strength, which takes into account income, assets of both students and parents if dependent, and the number of family members attending college.

A student is considered to have a financial need when their SAI is less than the school’s cost of attendance and does not exceed the maximum eligible SAI set annually. The determination of the federal aid package, including the Pell Grant, is made by the school’s financial aid office based on the information provided in the FAFSA.

Academic Requirements

Besides financial need, the program also has academic requirements. It is primarily awarded to undergraduate and vocational students who have not previously earned a bachelor’s or a professional degree through an online degree program or traditional institutions.

However, there are a few exceptions. Students who have earned a bachelor’s or a professional degree are typically ineligible, but those who have not accepted their degree and continue taking undergraduate courses may still qualify unless the institution determines the degree program as completed.

Students may qualify for Pell Grants if they pursue postbaccalaureate teacher certification or licensure programs that do not lead to a graduate degree and are necessary for state certification or licensing.

Other Eligibility Considerations

Pell Grant eligibility extends beyond financial need and academic requirements, incorporating factors like enrollment status. The number of credit hours a student enrolls in for a term determines the enrollment status for Pell Grant purposes. Part-time students qualify but receive an adjusted grant amount based on their enrollment status.

Significantly, from the 2024-2025 award year onwards, even students enrolled less-than-half-time will qualify for additional funds and college grants. And for students attending more than one school under a consortium agreement, their enrollment status is based on all the courses taken that apply to the degree or certificate at the home school.

The Maximum Pell Grant Funds Available

The Federal Pell Grant program aims to ensure that everyone has access to higher education, irrespective of their financial circumstances. For the 2023-2024 school year, the maximum Federal Pell Grant award stands at $7,395, and the minimum at $750.

Keep in mind, the total amount you receive hinges on factors like your cost of attendance (COA), the complete nine-month Expected Family Contribution (EFC), and the statutory COA guidelines that are contingent on attendance for a full academic year by a full-time student. The student’s enrollment status also determines the proration of funding, making full-time students eligible for 100% of the scheduled award, three-quarter time students for 75%, and half-time students for 50%.

Applying for a Federal Pell Grant

Applying for a Federal Pell Grant is a straightforward process. It all begins with completing the Free Application for Federal Student Aid (FAFSA) form annually. Completing the FAFSA requires less than one hour and includes providing an FSA ID, as well as information about the applicant’s parent or spouse if applicable.

It’s important to recall that students must complete the FAFSA form each academic year to uphold their eligibility for the Federal Pell Grant and secure their qualification for future financial aid. Once you complete the process, the school’s financial aid office determines your eligibility for a Pell Grant based on your enrollment or acceptance in a participating school.

How Federal Pell Grants Are Paid Out

After confirming your Pell Grant eligibility, colleges directly disburse funds to your account, to you, or use both methods. Disbursement dates usually align with semester starts. If grants exceed tuition, fees, and room and board, colleges must give remaining funds to students within 14 days. Schools and loan servicers notify students about disbursement times and any ‘credit balance’.

Utilizing Pell Grant Money Wisely

Receiving a Pell Grant is a significant financial boon, but it’s also a responsibility. It’s vital to allocate these funds judiciously, especially for direct school costs like tuition, fees, and crucial educational expenses that bolster academic success.

Resist the urge to spend Pell Grant funds elsewhere. Instead, create a budget to use the money wisely and save for future semesters or unexpected costs. View this grant as a chance to lessen your educational financial strain. Make every penny count!

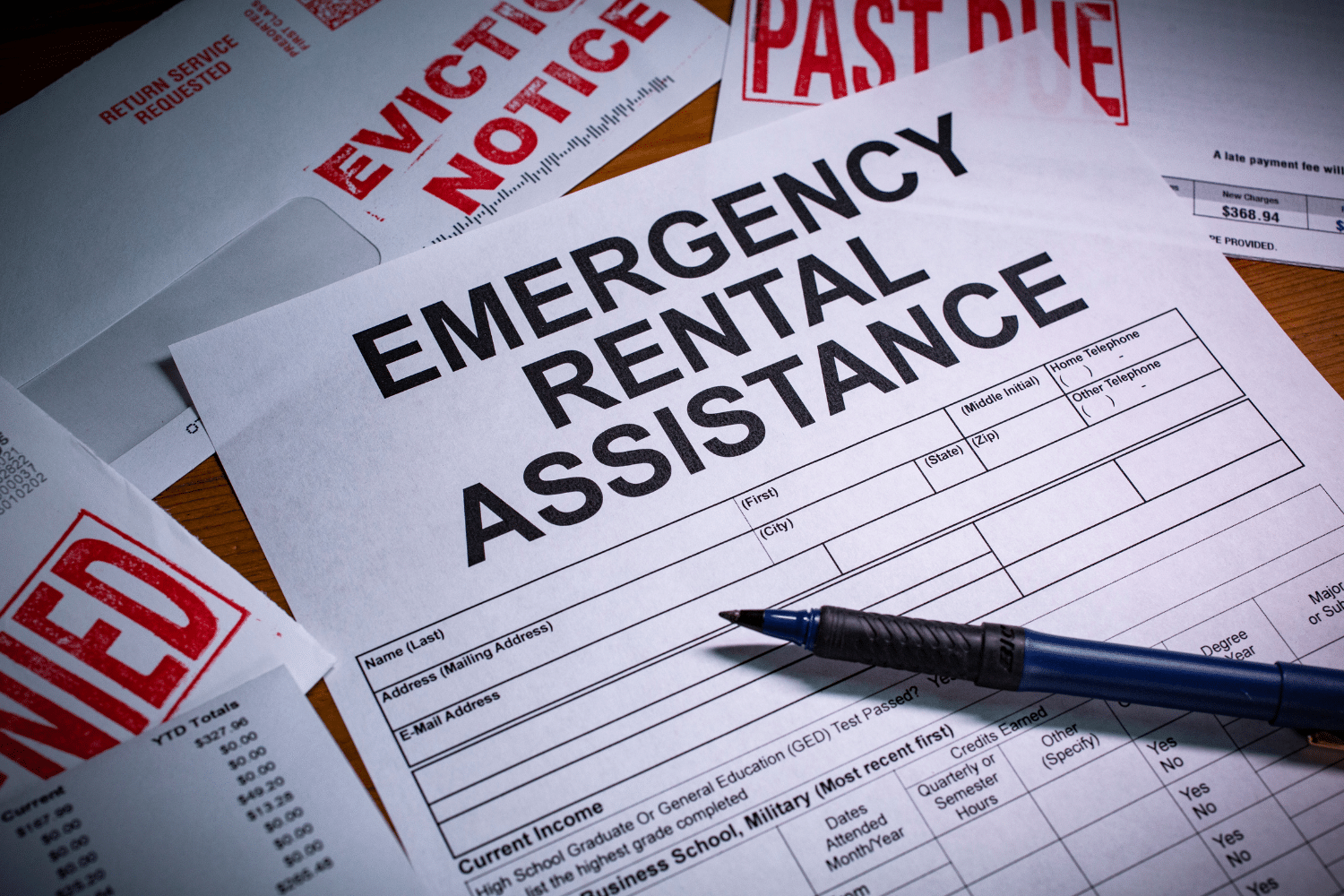

Responsibilities and Obligations

While Pell Grants are a fantastic way to finance your education, they come with certain responsibilities. Students must repay Pell Grant funds if they withdraw from courses or change enrollment status after disbursement.

Even a change from full-time to part-time enrollment status could obligate the student to repay a portion of the Pell Grant. Similarly, withdrawing from college mid-semester might require the student to repay Pell Grant funds corresponding to the incomplete course load. Thus, it’s paramount to consider these obligations while making academic decisions.

Exploring Additional Financial Aid Options

The Federal Pell Grant is just one of the many financial aid options available to students, including other federal grant options. Other options include:

- Need-based grants

- State grants

- The TEACH Grant

- Merit-based scholarships

These options can help cover educational expenses for those who attend school.

Financial need determines the awarding of need-based grants, while merit-based scholarships reward academic or other achievements. State grants are available in many regions and they typically consider both financial need and academic criteria for awarding aid. The TEACH Grant offers up to $4,000 annually for students intending to pursue a teaching career, with the stipulation that recipients must fulfill a service obligation or else the grant becomes a loan with interest.

Summary

In conclusion, the Federal Pell Grant is an invaluable resource for students in need of financial support. It provides a significant financial aid option that doesn’t require repayment. However, it’s important to understand the eligibility criteria, application process, disbursement methods, and responsibilities that come with it. In addition to the Pell Grant, there are other financial aid options like need-based grants, state grants, and the TEACH Grant that students can explore to secure their educational future.

Frequently Asked Questions

A student must enroll full-time in an eligible program and have an adjusted gross income within specific criteria to qualify for a Pell Grant.

Students use the FAFSA to apply for financial aid, and the Pell Grant offers aid based on financial need. The FAFSA shows the student’s financial need to the government and the school.

A Pell Grant usually does not need repayment. However, students who withdraw from courses after receiving the grant may need to repay it. Avoid these situations to prevent repayment.

If you have already earned a bachelor’s or professional degree, you are not eligible for a Pell Grant. You must also meet general federal student aid eligibility requirements.

The Federal Pell Grant is the most common need-based grant for eligible undergraduates without a bachelor’s or professional degree. It often represents the largest source of federal grant funds.