Need financial support for housing, education, or starting a business? A low income government loan might be the solution. In this guide, we’ll show you how to qualify, which types of loans are available, and how to apply.

Key Takeaways

- Low-income government loans, including FHA, USDA, and VA loans, provide affordable options for housing, education, and business development, specifically targeting individuals and families with limited income.

- To qualify for these loans, applicants must demonstrate an adjusted income below the area’s low-income limit, stable employment, and a reasonable credit history, though the terms are generally more flexible than conventional loans.

- The application process involves verifying eligibility, obtaining a certificate of eligibility, and submitting required documentation; borrowers can benefit from reduced financial burdens through lower down payments and interest rates.

Understanding Low Income Government Loans

Low-income government loans are a form of financial assistance provided by the federal government to help individuals and families with limited income achieve important life goals. These loans cover a wide range of purposes, including housing, education, and business development. Unlike federal grants, which do not need to be repaid, government loans must be repaid with interest, although they often come with more favorable terms than traditional loans. Additionally, loan guarantees can further enhance access to these financial resources.

The primary objective of these loans is to support low-income families in accessing affordable housing, education opportunities, and other essential services. These programs aim to reduce the financial burden on borrowers through lower interest rates and flexible repayment options, offering a pathway to financial stability.

Federal grants and loans play a crucial role in empowering individuals and families to improve their quality of life. These programs offer a lifeline to those in need, whether through payment assistance for housing or funding for educational pursuits.

Types of Low Income Government Loans

There are several types of low-income government loans available, each designed to meet specific needs and circumstances. These include FHA loans, USDA Rural Development loans, and VA loans. These programs each have unique benefits and eligibility requirements, catering to different population segments.

Here are the details of each type.

FHA Loans

FHA loans, insured by the Federal Housing Administration, are specifically designed to assist low-income families in purchasing homes. One of the key advantages of FHA loans is their lower down payment requirement, which makes homeownership more accessible for those with limited savings. In 2024, the loan limits for FHA loans range from $498,257 to $1,149,825, depending on the location and property type.

These loans also offer flexible credit requirements, allowing prospective homebuyers with lower credit scores to qualify. Families who might otherwise struggle to secure a mortgage loan from conventional lenders find this flexibility particularly beneficial. Additionally, FHA loans can be used for various purposes, including the purchase of an existing home, new construction, or refinancing real property.

FHA loans are a vital resource for families looking to achieve affordable housing. These loans empower more individuals to become homeowners by offering financial help with lower down payments and accommodating credit requirements.

USDA Rural Development Loans

USDA Rural Development loans are aimed at homebuyers in rural areas, offering zero down payment options to eligible individuals. These loans are particularly beneficial for first-time homebuyers who may not have substantial savings for a down payment. The competitive interest rates on USDA loans, made possible by government backing, further enhance their affordability.

One of the standout features of USDA loans is their focus on community development. These loans support the growth and sustainability of rural communities by enabling more people to purchase homes in rural areas. Focusing on rural development, these loans help individual homebuyers and contribute to the overall health of these areas.

USDA loans are an excellent option for those looking to buy a home in a rural setting. Requiring no down payment and offering favorable interest rates, these loans make homeownership a reality for many low-income families.

VA Loans

VA loans, offered by the Department of Veterans Affairs, are available to eligible veterans and their families. One of the most significant benefits of VA loans is the option for no down payment, which can make homebuying much more accessible for veterans. This feature is especially valuable for those who have served, as it reduces the initial financial burden associated with purchasing a home.

In addition to the no down payment requirement, VA loans often come with competitive interest rates and flexible terms. These benefits can significantly lower the overall cost of homeownership for veterans, providing them with much-needed financial relief.

VA loans are a testament to the government’s commitment to supporting those who have served our country. These loans help ensure that veterans and their families can achieve stable and affordable housing by offering financial assistance tailored to their needs.

Eligibility Requirements for Low Income Government Loans

To qualify for low-income government loans, applicants must meet specific eligibility requirements. One of the primary criteria is having an adjusted income that does not exceed the low-income limit set for their region. Determined by the area’s median income, these limits can vary significantly from one location to another.

In addition to income limits, applicants must demonstrate a willingness and ability to repay the loan. This includes providing evidence of stable employment and a reasonable credit history. However, the terms and conditions of these loans are often more flexible than conventional loans, making them accessible to individuals with lower credit scores or less stable income.

Another essential requirement is that the property purchased must be occupied as the applicant’s main residence and must not exceed the area’s loan limit. Furthermore, the property cannot be used for income-producing purposes. These stipulations ensure that the loans are used for their intended purpose of providing affordable housing to low-income families.

Application Process for Low Income Government Loans

The application process for low-income government loans involves several steps and requires careful attention to detail. Prospective homebuyers must first verify their eligibility by meeting the income and other requirements specific to the loan program they are interested in. Verification often requires documentation such as tax returns, pay stubs, and proof of residency.

Once eligibility is confirmed, applicants must provide a certificate of eligibility that meets their own eligibility requirements. This certificate must be presented to a participating lender for mortgage loan pre-approval. This step is crucial to demonstrate to lenders that the applicant meets the necessary criteria for the loan program. For programs like the Down Payment Assistance Program, applicants must also complete Homebuyer Education classes certified by counseling agencies.

The final step involves submitting the loan application along with all required documentation. Applicants can track their application status using a tracking number provided by the lender after submission. Adhering to all program guidelines and deadlines ensures a smooth and successful application process.

Benefits of Low Income Government Loans

One of the most significant benefits of low-income government loans is the reduced financial burden on borrowers. These loans typically require a smaller down payment, making it easier for low-income families to achieve homeownership. Many of these loans also include assistance for closing costs, further reducing the initial expenses of purchasing a home.

Another advantage is the lower interest rates compared to conventional loans. These reduced rates make monthly mortgage payments more affordable, helping borrowers manage their finances more effectively. These benefits are particularly impactful for first-time homebuyers, providing a more accessible pathway to owning a home.

These loans also offer opportunities for financial stability and upward mobility. Enabling borrowers to build a positive credit history and achieve long-term goals, these loans empower individuals and families to improve their overall financial health. The financial help provided by these loans can be a crucial step toward a brighter future.

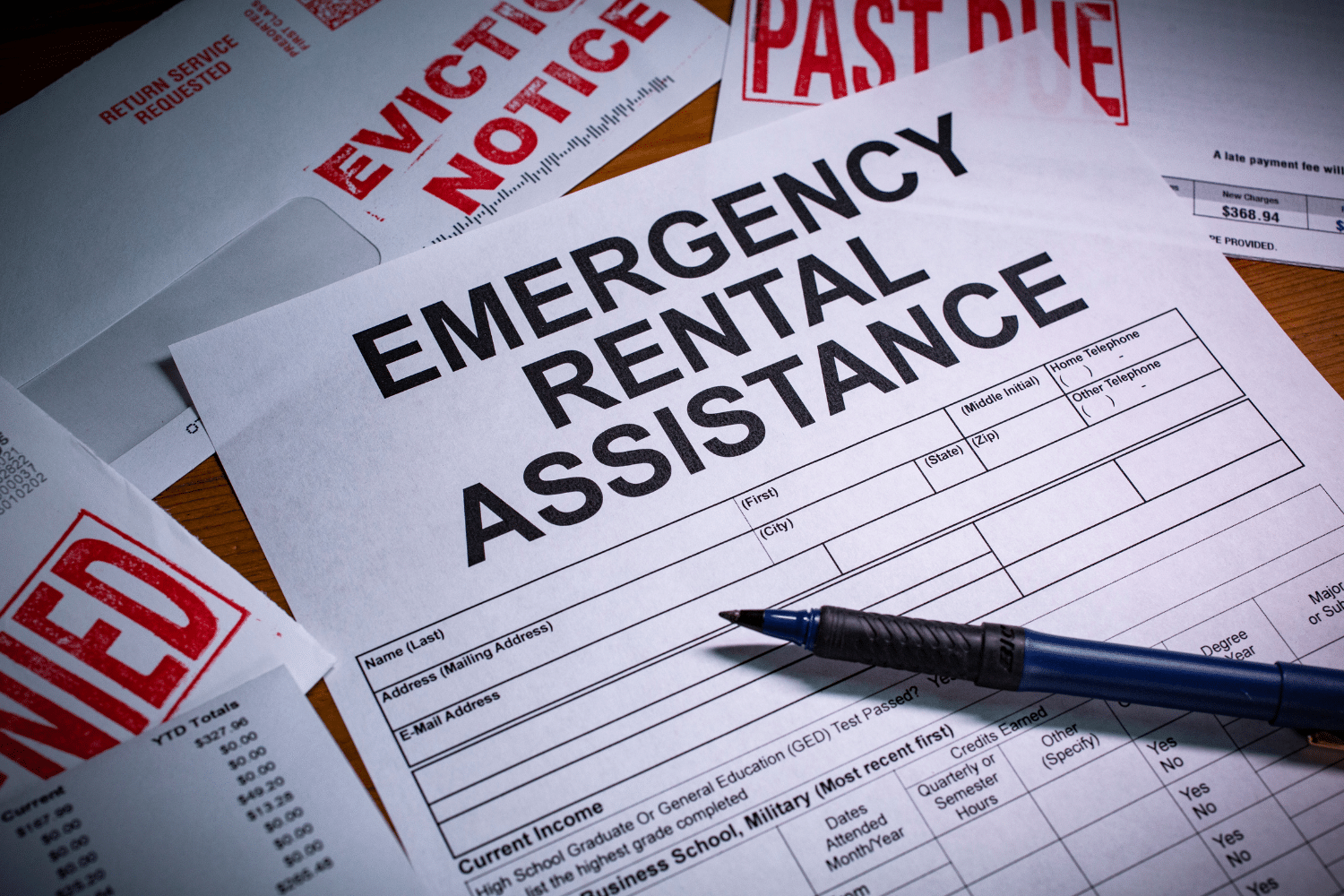

Avoiding Scams

While low-income government loans offer valuable financial assistance, it’s essential to be aware of potential scams. Fraudsters often pose as representatives of government programs, offering fake grants or loans and asking for personal information or money upfront. Be wary of any communication promising free money from the government, as these are typically fraudulent activities.

Always verify the legitimacy of any loan or grant offer with official government resources and never provide personal information or payment to unverified sources. If you encounter a potential scam, report it to the Federal Trade Commission for investigation. Staying informed and vigilant can help you avoid falling victim to these scams.

Additional Resources for Financial Assistance

In addition to low-income government loans, there are various other resources available for financial assistance. Government programs can help with costs related to education, housing, and business ventures, providing a broad range of support for different needs. For example, the USDA offers programs for home purchases, repairs, and refinancing in rural areas.

The HomeFirst Down Payment Assistance Program is another valuable resource, offering up to $100,000 toward down payment or closing costs. Additionally, local Community Action Agencies can provide information and referrals to other assistance programs, though they do not offer direct grants to individuals.

Exploring these local resources can provide the financial help needed to achieve your goals. Whether looking to buy a home, make necessary repairs, or invest in education, there are programs available to support your journey toward financial stability.

Summary

Low-income government loans are a powerful tool for individuals and families seeking financial assistance. By offering lower down payments, reduced interest rates, and flexible terms, these loans make homeownership and other goals more attainable. Understanding the different types of loans, eligibility requirements, and application process is crucial to taking advantage of these opportunities.

We encourage you to explore the various loan programs available and determine which ones best meet your needs. With the right financial help and resources, you can achieve your dreams and build a stable, prosperous future.

Frequently Asked Questions

Low-income government loans are financial products offered by the federal government to assist low-income families with necessary expenses such as housing, education, and business development, featuring favorable terms and lower interest rates than traditional loans. These loans aim to provide essential support for those in need.

To qualify for these loans, you must meet specific criteria related to income limits, property requirements, and your ability to repay the loan. It is essential to review the details of each loan program for precise requirements.

To apply for a low-income government loan, you must first verify your eligibility and then seek pre-approval from a participating lender, followed by the submission of the required documentation. Ensuring you have all necessary papers prepared will streamline your application process.

Low-income government loans offer significant advantages, such as lower down payments, reduced interest rates, assistance with closing costs, and more flexible credit requirements. These benefits make homeownership more accessible for individuals with limited financial resources.

To avoid loan scams, remain vigilant against offers promising free money and refrain from sharing personal information or making payments to unverified sources. Always report any suspicious activity to the Federal Trade Commission.