Are you seeking financial assistance for housing through HUD housing vouchers? Understandably, navigating subsidies can be complex. This article provides an essential guide to obtaining HUD Housing Choice Vouchers, covering eligibility criteria, the application process, and managing your housing costs once approved. With a focus on aiding low-income families, individuals, and the elderly, these vouchers are a lifeline for affordable housing. Here’s what you need to know to determine your eligibility and take your first steps toward receiving housing assistance.

Key Takeaways

- The Housing Choice Voucher Program, funded by HUD, is designed to assist low-income families in affording safe and sanitary housing through subsidies covering a portion of the rent and providing utility allowances.

- Eligibility for housing vouchers is primarily based on income, family size, and citizenship or eligible immigration status, with priority given to elderly, disabled individuals, and veterans through certain targeted initiatives.

- Securing a housing voucher involves an application process through local Public Housing Agencies, understanding the waiting lists, preparing necessary documentation, and once obtained, finding and leasing a HUD-compliant housing unit while adhering to the rights and responsibilities as a voucher holder.

Exploring the HUD Housing Choice Voucher Program

Picture a reality where affording a roof over one’s head is not hindered by income. This is the vision that fuels the Housing Choice Voucher Program, also known as the housing voucher program. Funded by the Department of Housing and Urban Development (HUD), this program serves as the federal government’s primary initiative for providing housing assistance to low-income families through subsidized housing projects. Its aim is not just to provide a place to live, but to uplift communities by guiding families toward suitable housing options that meet the goal of offering decent, safe, and sanitary housing.

What Are HUD Housing Choice Vouchers?

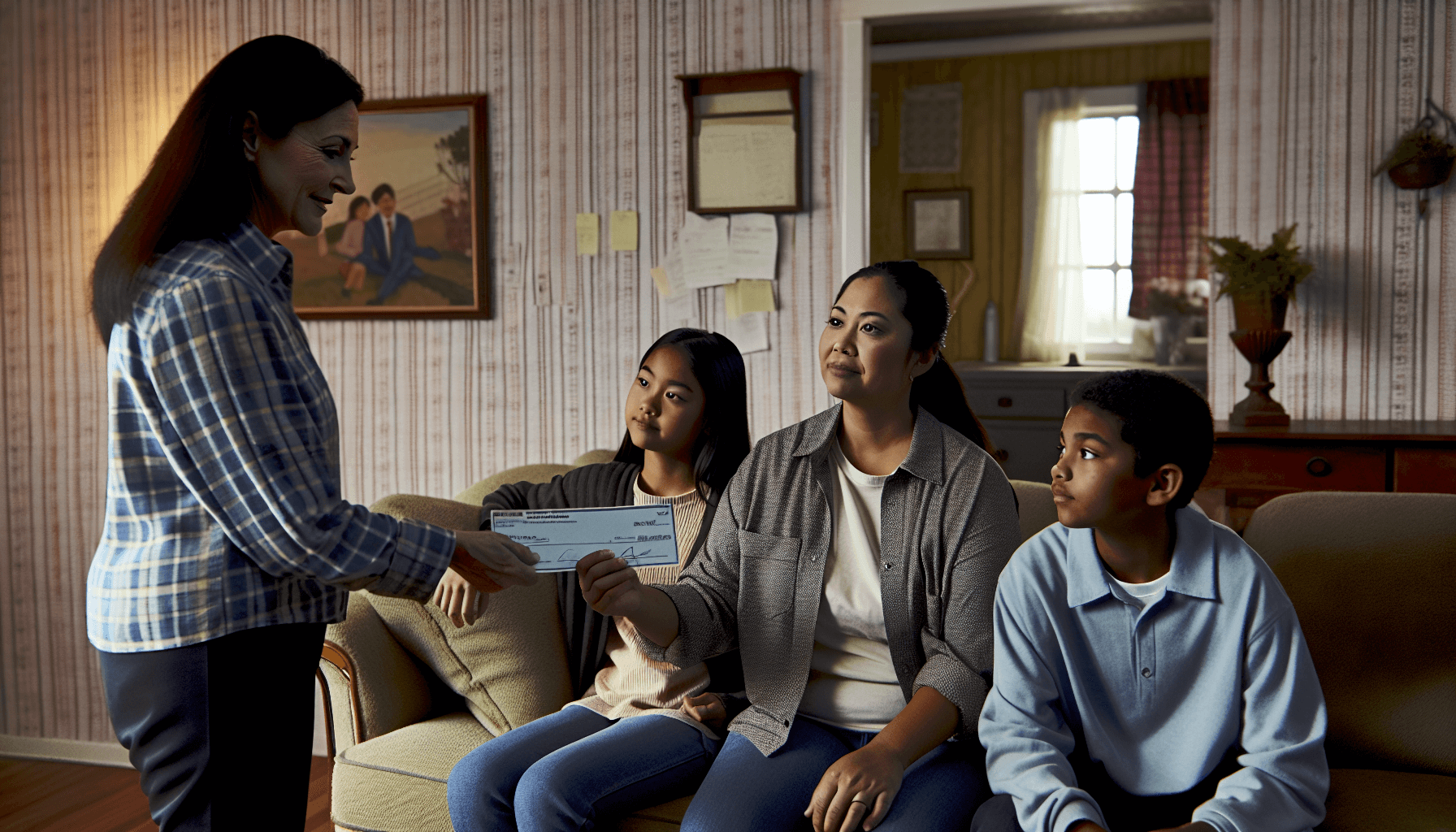

HUD Housing Choice Vouchers fundamentally serve as federal assistance that enables low-income families to afford housing. They are essentially a ticket to financial relief, covering a portion of the rent and allowing families to occupy private housing units.

The vouchers also come with utility allowances, providing additional financial support and ensuring that families do not have to compromise their well-being to afford decent utility bills.

The Role of Public Housing Agencies (PHAs)

Within each local community, Public Housing Agencies (PHAs) are the pillars that administer the voucher program. They work closely with families searching for housing and landlords offering rental units, bridging the gap between the two. Local housing agencies, as well as PHAs, can prioritize certain individuals and families based on specific housing needs or other established criteria, allowing them to customize their approach for the most effective assistance.

Types of Housing Covered

Whether you’ve always dreamt of living in a single-family home, townhouse, or apartment, the Housing Choice Voucher Program has got you covered. The program offers a wide range of housing options, as long as they comply with Housing Quality Standards and suit the size of the family.

Eligibility Criteria for HUD Housing Vouchers

Having delved into the basics of the Housing Choice Voucher Program, you may question your eligibility. Eligibility for housing vouchers is determined by several factors, including income limits, family size, and citizenship or eligible immigration status.

Income Requirements

Income significantly determines eligibility for HUD housing vouchers. HUD establishes Section 8 income limits by considering the area median income of the metropolitan area or county and defines tiers as extremely low income (30%), very low income (50%), and moderately low income (80%) of that median.

These income limits also vary depending on very low income families’ size and the cost of living in the area where the family resides.

Citizenship and Immigration Guidelines

Aside from income and family size, another key eligibility criterion is citizenship status. Applicants must provide verifiable evidence of U.S. citizenship or an eligible immigration status to qualify for a housing voucher. Even families that include both citizens and ineligible non-citizens can still receive Section 8 assistance, which will be proportionally based on the number of eligible members.

Additional Eligibility Factors

There are also additional factors affecting eligibility. For instance, elderly and disabled individuals are given priority when allocating housing vouchers due to their specific needs. Veterans also represent a group that has priority in receiving vouchers through the HUD-Veterans Affairs Supportive Housing program operating within the HCV initiative.

Applying for a HUD Housing Voucher

With the eligibility criteria laid out, it’s time to delve into the actual application process for a housing voucher. It involves contacting the local public housing agency, understanding waiting lists, and preparing necessary documentation.

Contacting Your Local Agency

The first step in the application process is to contact your local public housing agency. You can find their contact information through the official HUD website, where you can select your state from a list-box or use a provided map.

These agencies will then guide you through the process and direct you to property owners participating in the voucher program.

Understanding Waiting Lists

While applying for the voucher program, it’s crucial to understand that waiting times for housing vouchers can vary significantly across the country. Some families may face years of hardship, including the risk of homelessness and overcrowding, while waiting for a voucher to become available.

Preparing for the Application

Being prepared is key when applying for a Housing Choice Voucher. Applicants must provide personal documents such as birth certificates and social security cards for all family members, proof of income, and detailed information about all household members.

Ensuring you have all this information ready can expedite the application process, bringing you one step closer to securing your housing voucher.

Calculating Rent and Housing Subsidy

After successfully navigating the application process and obtaining your voucher, grasping how your rent and housing subsidies are determined is the next step. These calculations are based on your income, the established Payment Standard, and utility allowances.

Payment Standards and Family Contribution

The amount of assistance a family receives is determined by the Payment Standards set by the Housing Authority and the family’s adjusted gross income. Typically, families with housing vouchers are responsible for paying approximately 30% of their household’s adjusted income toward rent and utilities.

The Subsidy Calculation Process

The voucher holder’s income and the established Payment Standard determine the housing subsidy provided to the voucher holder. The calculation for the tenant’s share of the rent equals 30% of their monthly adjusted income, minus any utility allowance for utilities they pay directly.

Adjustments for Utility Allowances

In addition to the Payment Standard and income, utility allowances are also factored into rent calculations, which can impact the final actual rent amount paid by the tenant. Changes in payment standards and utility allowances, which are subject to modification, directly affect the amount of housing subsidy provided and the rent calculations for tenants.

Finding and Leasing a Suitable Housing Unit

Having secured your housing voucher and understood your rent and housing subsidy calculations, finding and leasing a suitable housing unit is the subsequent step. This involves searching for eligible properties, undergoing an inspection and approval process, and signing a lease agreement with the landlord.

Searching for Eligible Properties

You can search for eligible properties with assistance from the local Public Housing Agency (PHA), friends, family, and online housing search platforms that provide filters for ‘income-restricted’ rentals. You have the flexibility to choose from a wide range of properties, including private market rentals that meet the program’s safety and health standards.

The Inspection and Approval Process

Before you can sign a lease for your desired property, the housing unit must undergo an inspection to assess its conformity to minimum housing quality standards as mandated by HUD and enforced locally by the Public Housing Agency. Housing units must comply with specific health and safety standards, making sure they are clean, devoid of infestations, and have workable plumbing and electrical systems.

Lease Agreement and Landlord Participation

After the property passes inspection, you and the landlord must sign a lease agreement. The landlord also signs a housing assistance payments contract with the PHA, detailing all parties’ obligations.

As a voucher holder, you must pay your security deposit directly to landlords, without HUD financial assistance.

Rights and Responsibilities of Voucher Holders

Being a voucher holder comes with specific rights and responsibilities. These include tenant obligations, maintaining a healthy landlord-tenant relationship, and ensuring continued assistance.

Tenant Obligations

One of the primary responsibilities of tenants is to adhere to the terms of the lease agreement. This includes:

- Punctual payment of their share of the rent

- Maintaining the housing unit in a clean and well-maintained state

- Promptly reporting any changes in family size or income to the local public housing agency.

Landlord-Tenant Relationship

Voucher holders must maintain a healthy relationship with their landlords. They must ensure their guests do not damage the property. If issues arise, landlords must follow HUD eviction procedures.

Tenants can file a complaint through the Office of Fair Housing and Equal Opportunity if they believe their landlord violates program regulations or engages in discriminatory practices.

Ensuring Continued Assistance

To ensure continued housing assistance, voucher holders must comply with HUD’s program housing quality standards and permit annual inspections by HUD and Section 8 authorities. Should they encounter any issues with their voucher, they can seek help through the PIH Customer Service Center.

Maximizing the Benefits of Your Voucher

The Housing Choice Voucher Program serves as a potent instrument for securing stable housing. To maximize its benefits, you need to understand how to adapt to changes in your income, adjust to changes in your family size, and utilize the portability feature of your voucher.

Adapting to Income Changes

Adapting to income changes is a primary method to harness the maximum benefits of your voucher. If your income changes, report this to your PHA promptly, as this may impact the amount of your voucher assistance.

Family Size Adjustments

Changes in family size can also influence the size of the housing unit a voucher holder is eligible for and the amount of voucher assistance. Inform your housing authority when there is a change in family size.

Portability of Vouchers

Finally, the Housing Choice Voucher program includes a ‘Portability’ feature allowing families to transfer their rental subsidy to a different location outside the original issuing PHA’s jurisdiction. Before moving, it’s crucial to consider the following:

- The cost of living in the new location

- Payment standards in the new location, to ensure that the level of assistance does not decrease

- Any special needs, such as those for the elderly or disabled, and whether they can be accommodated in the new location.

Summary

In conclusion, the Housing Choice Voucher Program crucially helps low-income families secure decent, safe, and affordable housing. Understanding the program’s various aspects, eligibility criteria, application process, and tenant obligations equips you to navigate the system effectively. Remember, the goal is to not just provide a home, but to uplift communities and ensure everyone has access to decent, safe, and sanitary housing.

Frequently Asked Questions

HUD allocates federal funds to Public Housing Authorities (PHAs) in Ohio for the voucher program. The PHA directly pays a housing subsidy to the landlord on behalf of the participant. The participant then covers the difference between the actual rent and the subsidized amount. This arrangement aids low-income individuals in accessing housing in the private rental market.

To obtain Section 8 immediately in California, contact a Coordinated Entry System Access Center in your region. They will assess eligibility and refer you to the Emergency Housing Vouchers program. Local Housing Authorities manage this process through direct referrals.

The Housing Choice Voucher Program is the federal government’s main initiative for offering housing assistance to low-income families, providing vouchers to cover a portion of their rent and enabling them to reside in private housing units.

Eligibility for the Housing Choice Voucher Program is determined based on income limits, family size, and citizenship or eligible immigration status. These factors play a crucial role in determining who qualifies for the program.

To apply for a Housing Choice Voucher, contact your local public housing agency. They will assist you through the application process and connect you with participating property owners.