Navigating government checks in 2024 can be challenging. Whether you’re expecting Economic Impact Payments, tax refunds, or federal benefits, our guide directly addresses how to confirm eligibility, receive what you’re due, and handle payment issues, without overwhelming you with unnecessary details.

Key Takeaways

- The US federal government issues different types of checks to eligible individuals, including Economic Impact Payments with three rounds of disbursements, tax refunds based on overpayment or tax credits, and federal benefits such as Social Security and Veterans’ benefits.

- Individuals can track their government payments using online tools such as the ‘Get My Payment’ and ‘Where’s My Refund?’ features provided by the IRS, and they are advised to maintain updated banking details to avoid delays or missed payments.

- Setting up and regularly updating direct deposit information is essential for timely and secure receipt of government checks, and taxpayers should report any issues with lost, stolen, or expired checks promptly to the relevant agency.

Understanding Government Checks: Types and Purposes

The US federal government disburses several types of checks, each with its own specific purpose and criteria. Prominent among these are Economic Impact Payments, tax refunds, and federal benefits. These checks aim to provide financial assistance or rebates to eligible individuals, easing economic burdens and providing fiscal stimulus.

Economic Impact Payments, often referred to as stimulus checks or stimulus payments, were introduced as a direct relief measure during the COVID-19 crisis. As of 2024, there have been three rounds of disbursements, including the third economic impact payment. The amounts for each round are as follows:

- The first round, under the CARES Act, provided up to $1,200 per adult and $500 per qualifying child, with a cap of $3,400 for a family of four.

- The second round, authorized by the COVID-related Tax Relief Act, delivered payments of up to $600 per individual.

- The third round, authorized by the American Rescue Plan Act, provided payments of up to $1,400 per individual.

Economic Impact Payments: A Closer Look

Many have found the Economic Impact Payments to be a financial lifeline. Under the American Rescue Plan, the third round increased the payment to $1,400 per eligible individual or dependent, significantly relieving many families.

Eligibility for the full Economic Impact Payment is based on Adjusted Gross Income (AGI). Individuals with an AGI up to $75,000, heads of household with an AGI up to $112,500, and married couples filing jointly with an AGI up to $150,000 are entitled to the maximum amount. As the AGI levels rise above these thresholds, the Economic Impact Payment begins to phase out, with the reduction calculated as 5% of the excess AGI over the threshold. Qualifying children are eligible for an additional $500 per child, but the overall payment reduces for higher incomes based on AGI and filing status.

Tax Refunds: What You Should Know

Another common type of government check is the tax refund. These are issued when taxpayers overpay their taxes, usually due to payroll withholding or estimated tax payments, particularly for the self-employed. After processing your tax return, the IRS determines whether you’ve overpaid and issues a refund.

Additionally, claiming tax credits like the Child Tax Credit, Earned Income Tax Credit, American Opportunity Tax Credit, and Premium Tax Credit can also result in tax refunds. Refunds can be delivered in several ways, including direct deposit to a bank account, paper checks, or by purchasing U.S. savings bonds. The IRS offers guidance for those without a bank account and facilitates multiple direct deposit options, including splitting deposits between multiple accounts, using mobile apps, and prepaid debit cards.

Federal Benefits: Ensuring Timely Receipt

Federal benefits checks include programs like:

- Social Security

- Veterans’ benefits

- Supplemental Security Income (SSI)

- Disability benefits

These payments, including the third payment, offer crucial support for many, and as such, we encourage beneficiaries to use direct deposit to receive payments more quickly and securely than paper checks.

Ensuring the timely receipt of federal benefits involves maintaining up-to-date contact information and banking details with the agencies responsible for dispensing the benefits. This not only safeguards against potential issues but also ensures that beneficiaries can access their funds promptly.

Tracking Your Payment: Tools and Tips

It is crucial to keep track of your government payments, especially when awaiting state tax rebates or Economic Impact Payments. Tools like the respective state’s Department of Revenue website or online tools can help you track the status of these payments.

Maintaining up-to-date banking details is vital to prevent delays in receiving your economic impact payments. The IRS has a limit for the number of electronic refunds that can be directly deposited into a single account or prepaid debit card. Exceeding this limit will prompt the IRS to send a paper refund after issuing a notice.

In some cases, if a payment like Maine’s Winter Energy Relief Payment doesn’t arrive, you may need to contact the appropriate state authority, such as the State Tax Assessor, by a specified deadline to provide proof of eligibility.

IRS Get My Payment Tool

The ‘Get My Payment’ tool provided by the IRS allows you to check the status of your Economic Impact Payments, including the scheduled deposit or mailing date of your payment. To use this tool, you’ll need to provide your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), date of birth, street address, and ZIP or postal code.

The system updates the ‘Get My Payment’ tool once per day, usually overnight, eliminating the need to check more than once a day. If the tool displays a ‘Payment Status Not Available’ message, it means it cannot determine your eligibility, or your payment has not yet been processed.

Additionally, the IRS provides the ‘Where’s My Refund?’ feature on its website and the IRS2Go app to check the status of tax refunds, especially handy if you’re using direct deposit.

Contacting the Treasury Department

If you encounter issues with lost or stolen government checks, the first step is to contact the paying agency’s support services. In certain cases, for example, if rebate or benefit checks have expired, the responsible Department of Revenue can reissue those payments.

Direct Deposit Setup and Updates

Setting up and updating your direct deposit information for government checks, including tax refunds and federal benefits, is a critical part of ensuring you receive your funds promptly and securely. If you’re filing your taxes electronically, you can choose direct deposit to receive refunds by selecting this option in your tax software and providing your banking details.

However, you can change incorrect direct deposit information by calling the IRS at 1-800-829-1040, provided the IRS has not yet processed the refund. The IRS also offers options for taxpayers to recover funds or change their direct deposit details if the IRS has already sent a refund to the wrong account. If you’re filing tax returns on paper, you can opt for direct deposit for tax refunds by providing pertinent bank information on the appropriate paper form.

Using the IRS Portal

The Internal Revenue Service (IRS) Portal is a valuable tool that allows you to set up direct deposit for tax refunds and Economic Impact Payments. When selecting direct deposit as your refund method, ensure you provide your bank account and routing numbers, either through your tax software or by informing your tax preparer.

Prepaid debit cards and mobile apps with associated routing and account numbers are valid for receiving direct deposit tax refunds, after verification with the card issuer. It’s important to note that refunds must be directed to U.S. bank accounts or affiliated foreign accounts in your, your spouse’s, or joint names to avoid complications.

Even if you file your tax returns after the due date, the option for direct deposit remains available, providing flexibility for late filers.

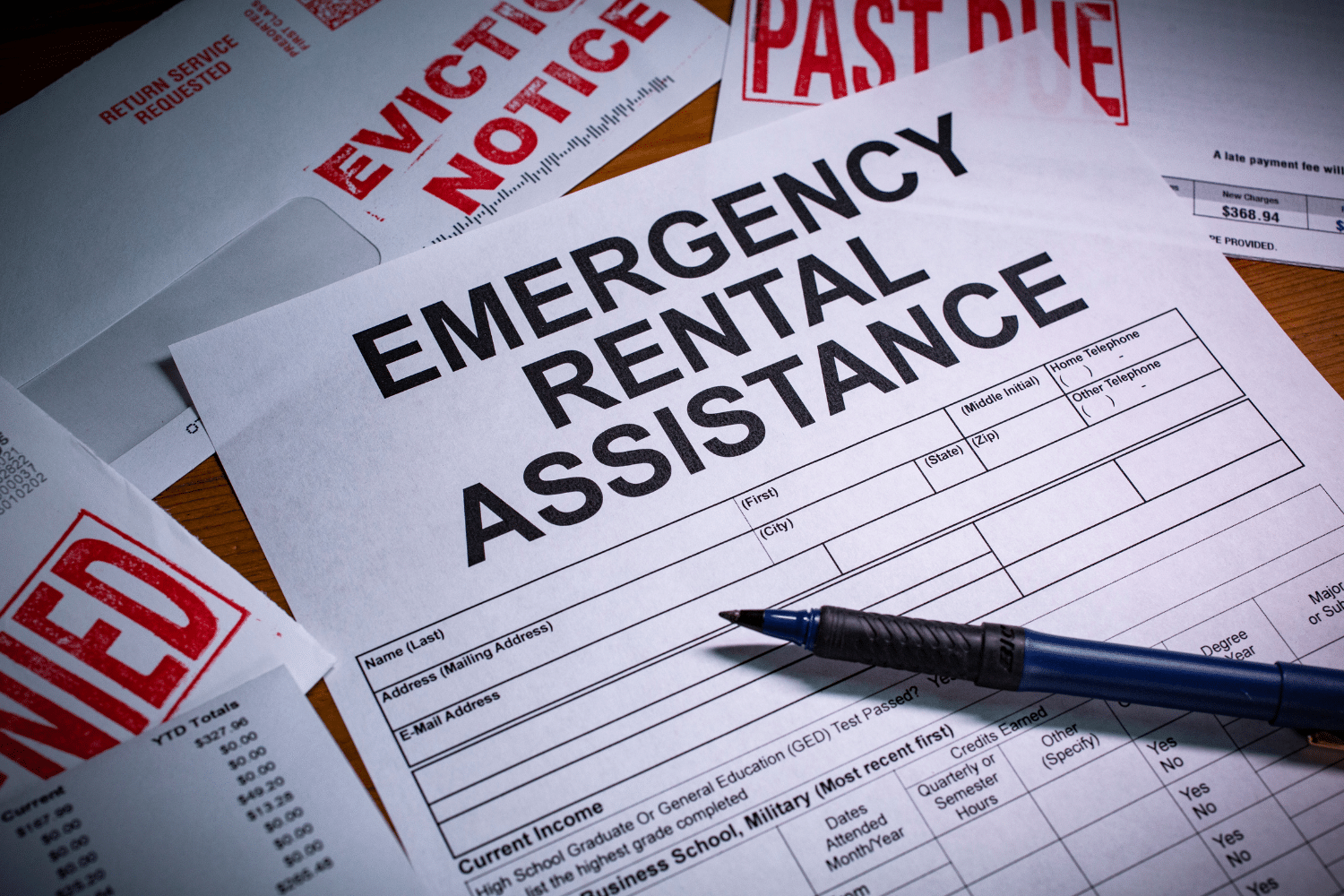

Reporting Issues with Government Checks

Prompt reporting is crucial if you encounter any issues with government checks, such as a lost or stolen check. To report the incident and initiate the claims process, follow these steps:

- Contact the paying agency to obtain the necessary forms for reporting the incident.

- Fill out the forms with the required information.

- Submit the forms to the paying agency.

- Keep a record of the date and time you reported the incident.

To check the status of your claim, you can contact the agency directly or use the number 1-855-868-0151, option 1.

In the case of expired government checks, the Bureau of the Fiscal Service can initiate a check reclamation process. This process involves the Bureau recovering funds due to issues like forged endorsements or negotiations of checks after the payee’s death. The time frame for reclaiming funds varies, but presenting banks are held liable for the check’s principal amount, along with any associated interest, penalties, and fees. You can use the A-Z Index of U.S. Government Departments and Agencies to find the appropriate issuing agency to report problems with government checks.

Please note that only presenting banks can submit protests against check reclamation to the Fiscal Service; individual customers or other entities cannot. For further updates on a claim, contact the Bureau of the Fiscal Service Call Center.

Navigating Changes in Filing Status

Changes in your filing status can significantly impact your eligibility for government checks. Whether you’re transitioning from single to married filing jointly or dealing with the loss of a spouse, understanding how these changes affect your payments is crucial. The Economic Impact Payment amounts vary based on an individual’s or couple’s filing status, such as single, married filing jointly, or qualifying widow.

Eligibility for full Economic Impact Payments typically extends to individuals with an adjusted gross income (AGI) up to certain thresholds, which can be different depending on the filing status. As adjusted gross income levels increase beyond the set thresholds, Economic Impact Payment amounts are reduced, with varying reduction percentages according to filing status.

Impact on Economic Impact Payments

What impact does a change in filing status have on Economic Impact Payments? Here are some key points to consider:

- If you’re married and filing jointly, you’re eligible for a higher maximum Economic Impact Payment compared to single filers. For example, the American Rescue Plan provided up to $1,400 for eligible individuals and $2,800 for married couples filing jointly.

- The income phase-out threshold for these payments is also higher for married couples filing jointly at $150,000, compared to $75,000 for single filers.

- If you transition from single to married filing jointly, your eligible Economic Impact Payment amount can increase, as long as your combined income stays below the joint phase-out threshold.

Conversely, the loss of a spouse may require you to change your filing status to single or qualifying widow(er), impacting the Economic Impact Payment received due to different associated adjusted gross income thresholds and phase-out amounts.

Adjusting to Life Changes

Life changes can bring about significant adjustments, including changes in tax filing status. After marrying, it’s essential for taxpayers to choose a new filing status, either ‘married filing jointly’ or ‘married filing separately’, to receive accurate tax calculations and eligibility assessments for government benefits like Economic Impact Payments.

If you’ve lost a spouse and have dependent children, you can file as a Qualifying Widow(er) for two years after the death of your spouse. This allows you to benefit from joint tax rates and the highest standard deduction without itemizing deductions, impacting the overall government checks you can receive.

Making Payments to the Federal Government

There may also be occasions when you need to make payments to the government, even though receiving payments from the federal government is critical. These payments can be made securely through several platforms including:

- Pay.gov

- Direct Pay

- Debit/credit cards

- Digital wallets

Pay.gov securely accepts payments from checking or savings accounts, and Direct Pay enables individuals to conduct fee-free transactions with the option to schedule payments up to a year in advance. Individuals and businesses can use debit cards, credit cards, and digital wallets to pay the IRS, although they may incur processing fees.

The Electronic Federal Tax Payment System (EFTPS) requires users to enroll before they can make tax payments or schedule estimated tax payments.

Maximizing Your Eligibility

After grasping the basics of government checks, you can begin exploring strategies to maximize your eligibility. This includes finding accessible banking options, understanding the impact of tax credits, and meeting state-specific criteria.

For individuals who do not typically file tax returns, such as senior citizens and Social Security recipients, the IRS can use information from Form SSA-1099 or Form RRB-1099 to determine eligibility for payments. Eligible taxpayers can benefit from the Child Tax Credit for 2023, which provides up to $2,000 per dependent, with up to $1,600 being refundable, impacting the overall government checks an individual or family can receive. State-specific criteria also play a role in eligibility for certain checks, as seen in the examples from:

- Alabama

- Arizona

- Minnesota

- Colorado

Summary

Navigating government checks, from understanding their types and purposes to tracking payments and adjusting to life changes, may seem challenging. Yet, with the right tools and knowledge, you can ensure timely receipt of these funds, manage changes in filing status, and even maximize your eligibility. Whether you’re receiving an Economic Impact Payment, awaiting a tax refund, or benefiting from federal programs, staying informed and proactive is the key to successfully navigating government checks in 2024.

Frequently Asked Questions

You can easily track your stimulus check through the IRS Get My Payment tool, an online portal designed to help you manage and monitor your Economic Impact Payments.

Yes, the US Treasury is sending out checks and direct deposits as part of the economic relief efforts, with the process continuing in the coming weeks.

Yes, the $1,400 subsidy is real and can add up to $5,600 for eligible families of four.

The Health Stimulus Card 2023 was designed to assist people in covering healthcare expenses related to the COVID-19 pandemic, such as medical bills and prescription medications.

You can claim your first stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return if you didn’t receive it. Make sure to file your 2020 tax return by May 17, 2024 to do so.