American emergency fund aid offers essential financial help during crises. This article covers benefits for military personnel, veterans, homeowners, renters, and small businesses. Learn about different aid programs and how to access urgent financial support.

Key Takeaways

- Various financial assistance programs are available for active duty soldiers and veterans, including Quick Assist Loans and scholarships for military families.

- The Auxiliary Emergency Fund supports American Legion Auxiliary members in financial distress, covering essential expenses up to $3,000 for those facing urgent needs.

- State and local governments have been provided substantial funds, such as the $350 billion from the American Rescue Plan, to bolster emergency assistance and enhance community resilience.

Financial Assistance Programs for Active Duty and Veterans

Navigating the complexities of financial assistance can be daunting, especially for those serving in the military and veterans. Various programs exist to provide emergency funding, grants, and other forms of aid tailored to meet the unique needs of active duty soldiers and veterans, ensuring they receive the support they need during challenging times.

Emergency Funding for Active Duty Soldiers

Active duty soldiers often face unexpected financial challenges, and emergency funding programs are designed to provide immediate relief. Quick Assist Loans, for instance, offer rapid financial aid up to $1,000 with a straightforward application process, making it easier for soldiers to manage urgent expenses without falling into debt traps. When stationed far from military installations, the American Red Cross steps in to provide support on behalf of Army Emergency Relief (AER), ensuring no soldier is left without assistance.

Emergency relief officers are stationed at military installations worldwide, offering on-site financial assistance. Soldiers can also seek aid from any military aid society if an Army post is unavailable, ensuring they have multiple avenues to secure the help they need.

Veteran Support Services

Veterans and their families can access various financial assistance programs tailored to address their unique needs. Organizations like the Army Emergency Relief (AER) provide scholarships for military spouses and children, helping them pursue educational opportunities without financial strain.

Additionally, federal programs offer diverse resources and support to ensure veterans receive the aid they deserve.

Auxiliary Emergency Fund for American Legion Members

The Auxiliary Emergency Fund (AEF) was established in 1969 to provide financial assistance to American Legion Auxiliary members facing significant hardships due to disasters or personal crises. This fund is crucial in ensuring that eligible members receive the support they need during challenging times, helping them recover and rebuild their lives.

Eligibility Criteria for American Legion Auxiliary Aid

Applicants must be active members of the American Legion Auxiliary for at least three consecutive years to qualify for aid from the Auxiliary Emergency Fund for eligible applicants. They must not be junior members and must provide documentation of their financial situation to demonstrate need.

Types of Expenses Covered by the Auxiliary Fund

The Auxiliary Emergency Fund covers essential expenses such as home repairs, medical bills, and other expenses related to urgent financial needs. Grants can cover emergency expenses up to $3,000 for damages resulting from disasters, ensuring members can address critical costs without undue financial burden.

State and Local Government Emergency Funds

State and local governments play a vital role in providing emergency financial assistance to their communities. The American Rescue Plan allocated $350 billion to help state and local governments recover from the economic impacts of the COVID-19 pandemic, ensuring that essential services and support systems remain operational during crises.

Coronavirus State and Local Fiscal Recovery Funds

The Coronavirus State and Local Fiscal Recovery Funds (SLFRF) are part of the American Rescue Plan, providing $350 billion to support government recovery efforts from the COVID-19 pandemic. These funds are crucial for addressing long-lasting economic harm and ensuring communities have the resources needed to recover and thrive.

Capital Projects Fund

The Capital Projects Fund focuses on enhancing infrastructure in rural and low-income communities, promoting digital connectivity and infrastructure equity. Funding projects that improve broadband, water, and sewer infrastructure, this initiative directly impacts community resilience and ensures equitable access to modern amenities.

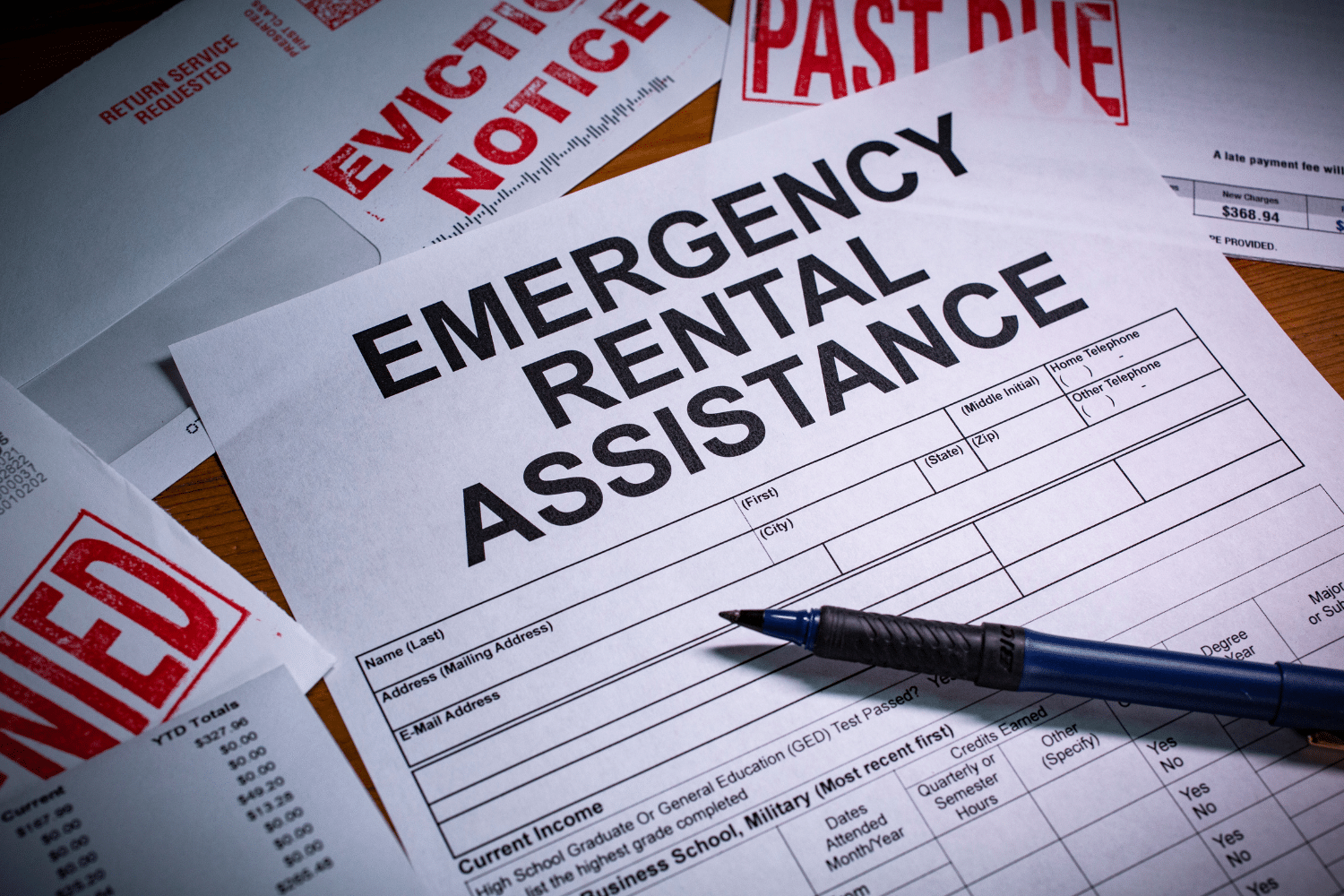

Homeowner and Rental Assistance Programs

The federal government has implemented various programs to support homeowners and renters facing financial challenges due to emergencies or other personal crisis. These programs aim to alleviate financial stress and help individuals and families maintain stable housing during crises.

Homeowner Assistance Fund

The Homeowner Assistance Fund, with nearly $10 billion allocated, supports vulnerable homeowners at risk of foreclosure due to COVID-19-related hardships. This fund has already assisted over 549,000 homeowners, preventing foreclosures and utility losses by covering mortgage payments, insurance, and utility expenses.

Emergency Rental Assistance Program

The Emergency Rental Assistance Program has allocated $21.6 billion to aid households struggling with rent and utility payments due to financial hardships. This substantial funding ensures that families can maintain their housing stability during economic crises, providing crucial support when it is most needed.

Small Business and Community Support Initiatives

Small businesses and local communities are the backbone of the economy, and the American Rescue Plan has allocated significant funds to support their recovery and resilience. These initiatives aim to provide essential resources to bolster economic recovery and enhance community resilience.

State Small Business Credit Initiative

The State Small Business Credit Initiative (SSBCI) is a $10 billion program aimed at increasing access to capital for small businesses. Leveraging $10 in private investment for every $1 of public funding, this initiative enhances small business credit programs across states, fostering economic growth and stability.

Local Assistance and Tribal Consistency Fund

The Local Assistance and Tribal Consistency Fund provides $2 billion to support eligible counties and Tribal governments. This fund aims to enhance revenue for local governments, promoting stability and growth by ensuring they can maintain essential services and invest in community infrastructure.

How to Access Emergency Fund Aid

Accessing emergency fund aid requires following specific processes and contacting the appropriate authorities. Understanding these steps ensures that eligible individuals can quickly receive the financial assistance they need during a crisis.

Contacting Your Chain of Command

Engaging your chain of command is crucial for expedited assistance. Your chain of command can refer you to the on-post Army Emergency Relief (AER) officer and approve up to $2,000 in immediate financial assistance through the Quick Assist Program, providing rapid support in times of need.

Visiting an Emergency Relief Officer

All soldiers, including those who are active and retired, can seek financial assistance. They should visit their nearest AER officer for help. These officers are available at military installations worldwide, providing on-site aid to address various financial needs.

If there is no Army post nearby, soldiers can seek assistance from any military installation or military aid society.

Utilizing the American Red Cross

For those not near a military installation, the American Red Cross offers a viable option for financial assistance. Accessing this aid is straightforward and can be done through a simple phone call, ensuring that help is available no matter the location.

Educational and Childcare Support

Educational and childcare support programs are essential for military families, providing the financial assistance needed to ensure their children receive quality education and care. The American Rescue Plan has allocated significant funds to stabilize the childcare sector and support educational opportunities.

Educational Scholarships for Military Families

Spouses and children of active and retired soldiers are eligible for educational scholarship programs offered by the Army Emergency Relief (AER). With an annual allocation exceeding $13 million, these scholarships help military families cover education costs, ensuring their children’s academic success.

Childcare Assistance Programs

Military families struggling to access on-base childcare services due to waiting lists or distance can apply for the Army Fee Assistance program. This program provides financial aid for up to three months, helping families manage childcare costs and ensuring their children receive quality care.

Auxiliary programs are also available to address the financial burden of childcare.

Loan and Grant Options

Various loan and grant options are available to assist those in need of financial support during emergencies. These options provide immediate relief without the burden of repayment, helping individuals regain financial stability more effectively.

Quick Assist Loans

Quick Assist Loans offer up to $1,000 with a simple application process. It provides immediate financial relief to active duty service members. This program serves as a safe alternative to predatory lending practices. It ensures soldiers can manage urgent expenses without falling into debt traps.

Wounded Warrior Comfort Grants

The Wounded Warrior Comfort Grants provide financial support to soldiers medically evacuated from hostile fire or imminent danger areas. Each eligible individual receives a fixed amount of $1,000. It ensures they have the necessary funds to support their recovery without additional financial stress.

Summary

Navigating financial crises can be overwhelming, but numerous programs are available to offer support. Whether you are an active duty soldier, a veteran, a homeowner, a renter, or a small business owner, there are tailored financial assistance programs designed to meet your specific needs. Understanding these resources and how to access them is crucial in mitigating the impact of financial hardships.

From emergency funding and grants to educational scholarships and childcare assistance, the comprehensive support systems in place aim to provide stability and resilience. By leveraging these resources, individuals and communities can overcome financial challenges and rebuild stronger. Remember, help is available, and taking the first step to access it can make all the difference.

Frequently Asked Questions

The American Rescue Plan is designed to provide direct funding to states, counties, and municipalities. It addresses the economic challenges presented by the Covid-19 pandemic, particularly revenue shortfalls and increased spending needs. This support aims to bolster recovery efforts across various levels of government.

To be eligible for the FAFSA emergency fund, students must have filed a Free Application for Federal Student Aid or be eligible to file one. This ensures they qualify for federal financial aid programs.

Yes, the emergency relief program is real. It has been established by Congress to assist with repairing or replacing infrastructure and support agriculture affected by natural disasters and emergencies. It serves as crucial financial support for states and communities recovering from significant events.

Active duty soldiers can access emergency funding via Quick Assist Loans. They can get funding by contacting emergency relief officers at their military installations. They can also contact hrough the American Red Cross if they are located far from an Army post.

To be eligible for the Auxiliary Emergency Fund, you must be an active member of the American Legion Auxiliary. A minimum of three consecutive years is required. You must also submit documentation of your financial situation.