Accessing healthcare subsidies can significantly lower your insurance costs — but where do you start? Discover your eligibility and learn the step-by-step process to apply for these financial aids, tailored to make healthcare affordable. Dive into the essentials, from federal to state-funded options, without the fluff.

Key Takeaways

- Health insurance subsidies provided by the Affordable Care Act (ACA), including the Advanced Premium Tax Credit and Cost-Sharing Reductions, are designed to make healthcare more affordable for low to moderate-income individuals, with recent legislative changes expanding accessibility.

- Eligibility for healthcare subsidies is based on a combination of household income (100% to 400% of the Federal Poverty Level), family size, and legal residency in the United States, with factors such as high-cost living areas and family dynamics influencing subsidy amounts.

- Applicants can use online tools and seek assistance from licensed agents to navigate the subsidy application process and must report any changes in circumstances to properly adjust subsidies and renew them annually during the Open Enrollment Period.

Understanding Healthcare Subsidies

Subsidies in healthcare, specifically health insurance subsidies, are more than a buzzword—they are a critical component in the architecture of accessible healthcare. These financial aids, designed for individuals with low to moderate income, aim to increase health insurance coverage and ensure better access to medical care. But how do these subsidies work, and what forms do they take?

We’ll explore the mechanisms that make healthcare affordable for millions.

Federal Healthcare Subsidies

At the federal level, the Affordable Care Act (ACA) has been a game-changer, offering two main types of subsidies: the Advanced Premium Tax Credit (APTC) and Cost-Sharing Reductions (CSRs). These federal premium tax credits help reduce the financial burden of health insurance premiums and out-of-pocket costs for those who qualify. The APTC lowers monthly insurance payments across all levels of Marketplace plans, with the exception of catastrophic coverage. Meanwhile, CSRs are a boon for individuals enrolled in Silver plans, as they work to minimize deductibles and copayments.

Legislative changes, like those under the American Rescue Plan Act and adjustments to the IRS ‘family glitch’ in 2023, have broadened the horizon of who can benefit from these subsidies, making them more accessible to a wider income range.

State-Funded Healthcare Subsidies

Venturing beyond the federal landscape, some states have taken matters into their own hands, offering additional federal subsidies to further ease the cost of health insurance for their residents. These state-funded premium subsidies or cost-sharing reductions are available in states that run their own exchanges, such as:

- Massachusetts

- Vermont

- California

- New Jersey

- New Mexico

For instance, New Jersey provides up to $100/month for individuals earning up to 600% of the Federal Poverty Level (FPL), while Vermont extends support for those up to 300% of FPL. These state initiatives complement federal efforts, creating a more robust safety net for affordable health insurance coverage.

Eligibility Criteria for Healthcare Subsidies

Determining eligibility for healthcare subsidies is akin to assembling a puzzle—each piece must fit perfectly for a complete understanding. Income level, family size, and residency are the primary pieces of this puzzle. We’ll begin by examining the financial threshold that determines who can benefit from these subsidies.

Income Requirements

The heart of subsidy eligibility beats to the rhythm of household income, specifically within the range of 100% to 400% of the Federal Poverty Level (FPL). The lower the income, the larger the subsidy, with a gradual decrease in assistance as one’s income approaches the upper limit. Individuals earning between 100% and 250% of the FPL may qualify for both Advance Premium Tax Credits and Cost-Sharing Reductions, while those above this range might only be eligible for the tax credits.

Even those living in high-cost areas might find a lifeline in subsidies if their income slightly exceeds the 400% FPL threshold.

Family Size and Residency

The number of people under your roof and where that roof is located can significantly impact subsidy amounts. Life events such as marriage or the birth of a child necessitate a reevaluation of your subsidy since they influence your household’s income percentage of the poverty level. Moreover, adding more than three children to your family may lead to a decrease in after-subsidy insurance premiums, providing a financial breather thanks to insurers capping charges for children.

For young adults, the shelter of their parents’ health insurance through the exchange extends until the age of 26, with subsidies calculated based on the total household income, independent of their tax-filing status. And let’s not overlook the importance of residency—proof of legal residency or citizenship is a must to unlock the door to subsidies, ensuring lawful presence in the United States.

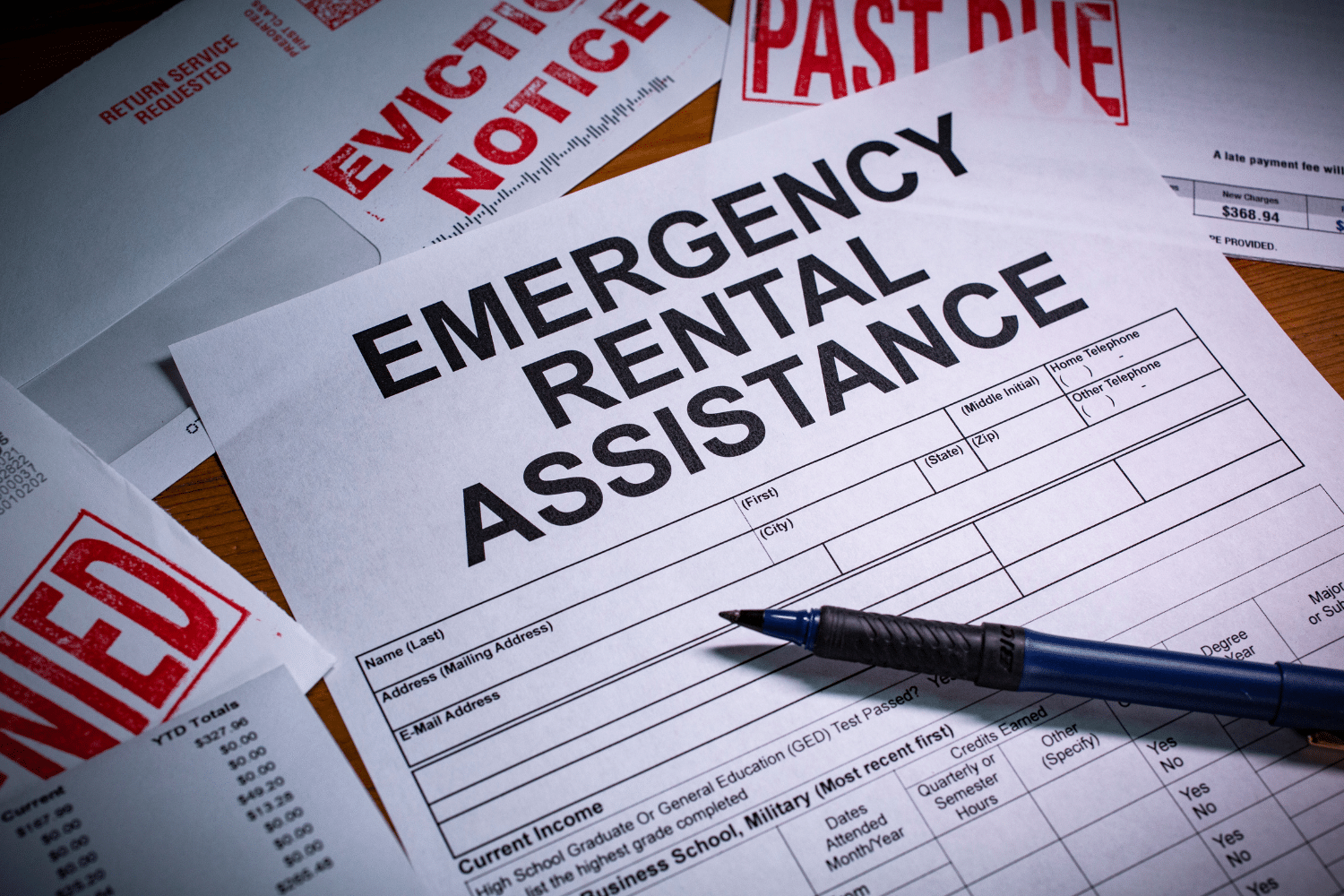

Applying for Healthcare Subsidies

Once you comprehend what subsidies are and who can benefit, the subsequent step involves the application process. It can seem daunting, but with the right map in hand, you can navigate the terrain with confidence.

Whether through a government-run health insurance Marketplace or a qualifying licensed agent, financial assistance for marketplace coverage is within reach.

Documents and Information Needed

To begin this process, you’ll require certain essentials:

- Proof of income, such as recent tax returns, W-2s, pay stubs, or documents for self-employment income

- Personal identification, such as a passport or a birth certificate combined with a government-issued ID

- Details of your legal residency

- Social Security Number for each family member to ensure everyone is accounted for in the subsidy equation

Don’t forget to include your current health coverage information and proof of home address, which will anchor you firmly in the subsidy landscape.

Using Online Tools and Licensed Agents

In this digital age, online tools provided by the official health insurance Marketplace website can simplify the application process, guiding you through each step with ease. If you prefer a human touch, licensed agents and brokers stand ready to assist. They are certified by the Marketplace to help decipher options, complete applications, and enroll you in a health plan that meets your needs.

Making the Most of Your Healthcare Subsidies

Securing subsidies is a victory, but making the most of them is the true goal. Selecting the appropriate plan and remaining alert to changes in your circumstances are key to maximizing the benefits of your healthcare subsidies.

Choosing the Right Plan

When it comes to selecting a health plan, consider it a balancing act between premium costs and out-of-pocket expenses. The ACA Health Insurance Marketplace offers a spectrum of plans, from Bronze to Platinum, each with its own cost-sharing structure. Bronze plans might appeal to those seeking minimal coverage with maximum out-of-pocket protection, while Platinum plans are tailored for those desiring extensive coverage and are comfortable with higher premiums.

The Silver plan, however, is where cost-sharing reductions shine, offering out-of-pocket expenses comparable to higher-tier plans for those who qualify. Your individual health needs and financial situation will guide you in striking the right balance and choosing the plan that fits you best.

Reporting Changes and Renewing Subsidies

The landscape of your life is ever-changing, and so too should be the details of your subsidy. Any changes in income, family size, or other relevant circumstances must be reported to the Health Insurance Marketplace promptly. Failing to do so could lead to an imbalance in your Advanced Premium Tax Credit payments and unwelcome surprises during tax time.

Remember, ACA subsidies aren’t set-and-forget; they require annual renewal, usually during the Open Enrollment Period, to ensure they reflect your current situation and needs, including your monthly premiums.

Healthcare Subsidies for Dental and Vision Coverage

The umbrella of healthcare subsidies also extends to shelter some of the costs associated with dental and vision coverage. However, there are nuances to understand in this area, particularly when it comes to standalone plans.

Dental and vision care are often considered the finishing touches to comprehensive health insurance coverage. While subsidies can lower the cost of health plans that include these benefits, it’s important to note that standalone dental and vision plans are generally not eligible for subsidies. Dental plans through the Marketplace can be layered onto your health plan for an additional premium, offering varying levels of coverage to suit different needs.

Pediatric vision care is a staple in ACA-compliant plans and includes essential services like eye exams and corrective lenses for children, although the specifics can vary by state.

Undocumented Immigrants and Healthcare Subsidies

The issue of healthcare access for undocumented immigrants is a tapestry of policies, with some states weaving threads of inclusion within their healthcare systems. We’ll focus on how these states are pushing boundaries in healthcare accessibility.

In California, a bold stride has been made with Medi-Cal’s expansion to cover undocumented immigrants of all ages, including those eligible for the children’s health insurance program. This policy took full effect in 2024. Oregon, too, has removed age restrictions for its low-income state health insurance program, and other states like Colorado and Washington have followed suit with their own initiatives. This expansion is more than just a policy change—it’s an act that can lead to healthier communities by lowering rates of chronic conditions and improving overall well-being among the undocumented immigrant population. Plus, for many, enrolling in these programs carries no risk to immigration status or unwanted sharing of personal information with federal authorities.

Summary On Accessing Healthcare Subsidies

As we reach the end of our journey through the intricate world of accessing healthcare subsidies, we hope you feel equipped with the map and compass to navigate these waters. Remember, understanding the variety of subsidies available, meeting the eligibility criteria, and applying with the proper documentation are key to securing financial assistance. By choosing the right plan and keeping your information up-to-date, you can make the most of these subsidies and ensure that your healthcare coverage is both comprehensive and affordable. Take this knowledge, step confidently into the healthcare marketplace, and embrace the healthier future that lies ahead.

Frequently Asked Questions

You may still qualify for healthcare subsidies even if your income is slightly above 400% of the Federal Poverty Level, especially if you live in an area with higher living costs. Keep this in mind when exploring healthcare options.

If you don’t report changes in your income or family size to the Marketplace, it can result in incorrect subsidy payments and potential adjustments during tax reconciliation. Keeping your information accurate is crucial to avoid these issues.

No, state-funded healthcare subsidies are only available in certain states with their own exchanges, in addition to federal support. HealthCare.gov does not offer additional state-funded subsidies.

Undocumented immigrants are not eligible for federal healthcare subsidies, but some states have expanded their healthcare programs to cover this population, such as California’s Medi-Cal.

Unfortunately, ACA subsidies do not apply to standalone dental and vision plans, but they can help lower the costs of health plans that include dental and/or vision coverage.